|

Town Hall

16 School St.

Allenstown, NH

603-485-4276

Check town web site for current business hours.

Taxes to Concord and Back

March 17, 2019

After a few discussions with Finance Director, Debbie Bender, the following details can be presented for your illumination. The intent is to take the mystery out of the process used to determine each component of the property tax.

POP QUIZ: How can you avoid paying any property tax?

See the end of the article for the answer.

Off to the DRA

The town administrator and school board send to the Department of Revenue Administration (DRA) on Pleasant St. in Concord details about the town budget, school budget, sewer budget, and all anticipated revenue and grants for the current tax year. This is done annually in September. Note that the property tax year runs from April 1 to March 31 per RSA section 76:2.

Around the same time, Merrimack County officials send the DRA the county tax assessment for Allenstown and other cities and towns.

Also in September, the town tax assessor (currently Avitar Associates) sends to the DRA its compilation of the total valuation of all properties in town. Taxable properties include public utilities like utility poles. (Don't ask why. This is a can of worms being debated in the legislature.) The DRA has a lot of work on its plate considering that there are 221 towns, 13 cities, and 25 unincorporated places in New Hampshire, and 1.36 million people who might think the property taxes are too high.

Excluded Properties

Properties that are excluded from taxation are Bear Brook State Park (the biggest exemption), town-owned properties like Town Hall and parcels taken for failure to pay back taxes, school-owned properties like ARD and AES, the Waste Water Treatment Facility on Ferry St., churches, and properties owned by non-profit organizations like Pine Haven Boys Center on River Rd.

The Tax Rate Breakdown Form

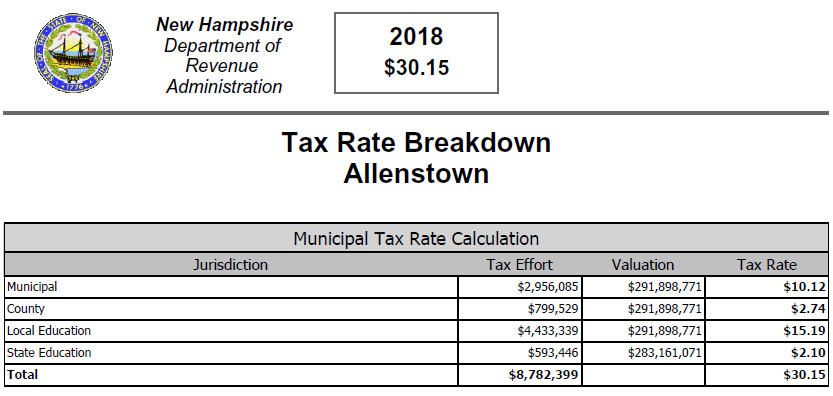

The DRA munges all this data together in some mysterious way (which will be ignored to prevent your eyes from glazing over) and sends town hall officials a Tax Rate Breakdown form around the end of October. The significant portion of this four-page form is shown below. This form, dated Oct. 26, 2018, established the final tax rate for 2018, one that was about $2 less than the 2017 rate.

Portion of Final 2018 Tax Rate Breakdown from the DRA

Terminology on the Form

To understand what this form contains, let's first tackle some terminology in the first column of the form. Jurisdiction is the governing authority that needs to collect taxes to cover its approved expenditures. Municipal refers to the town government, County refers to Merrimack County's government, Local Education refers to the local school district, and State Education refers to the tax that the DRA requires the town to collect, per RSA section 76:8 II, and pay to the school district. In effect the actual school tax rate is $15.19 + $2.10 = $17.29, which is almost twice the town rate.

In the second column of the form, Tax Effort refers to the net budget after subtracting any revenue and grants from the gross budget. The name refers to the fact that it's such an effort to get people to pay their taxes on time. This is the net amount that must be paid by property taxes. The other two columns list the total value of all properties in town and the tax rate per $1,000 of assessed value. For some reason, the valuation for State Education does not include the value of utilities.

Calculating the Tax Rate

To calculate the tax rate for each Jurisdiction, divide the Tax Effort by the Valuation and multiply by 1000.

Use this formula:

TE / V x 1000 = TR

For example, since Local Education is the school tax, $4,433,339 / $291,898,771 x 1000 = $15.18792, which rounds up to $15.19/$1,000. This tax rate is the amount you see on your tax bill, under the mislabeled heading "TAX CALCULATION." The entries under that heading on the tax bill don't quite match the Jurisdictions used on the DRA form and they are not in the same order, which makes for a less than simple comparison.

This is possibly one of those cases of inconsistency where the designer of the town tax bill did not pay attention to the design of the DRA form.

Thank Heavens for the Tax Effort

If you focus on the Local Education row, the net school budget to be paid by taxes was $4,433,339, but the approved 2018 school budget was $9,981,355. If the DRA had calculated the tax rate based on the approved budget, the school tax rate would have been:

$9,981,355 / $291,898,771 x 1000 = $34.19

Holy Moley!

What You Can Do

Request that the DRA Tax Rate Breakdown form be published on the town web site and advertised to residents as soon as it becomes available.

QUIZ ANSWER: How to Avoid Paying Any Property Tax

Don't own any taxable property.

Don't stop living in your parent's basement.